How money literacy improves physician well-being, clinical focus, and long-term practice success

Keywords: financial education for doctors in India, financial literacy among physicians, financial planning for doctors, financial stress in healthcare professionals, investment basics for doctors, wealth management physicians India

Introduction

Indian doctors receive extensive training in diagnosis, patient care, evidence-based treatment, and medical ethics, but almost none learn about personal or practice finance. This gap leaves many physicians with limited financial skills, even as they face high responsibility, complex income structures, and early career debt.

In a country where financial literacy among adults is estimated at under 30%, this shortfall poses real risks to doctors’ careers and well-being, as well as to their patients.¹

This article explains why financial education matters for doctors in India, highlights systemic challenges, presents research and statistics, and outlines practical steps for medical schools, professional bodies, and individual doctors.

1. The National Context: Financial Literacy in India Is Low

India has made progress in financial inclusion, but financial literacy—the ability to make informed and effective financial decisions—remains weak:

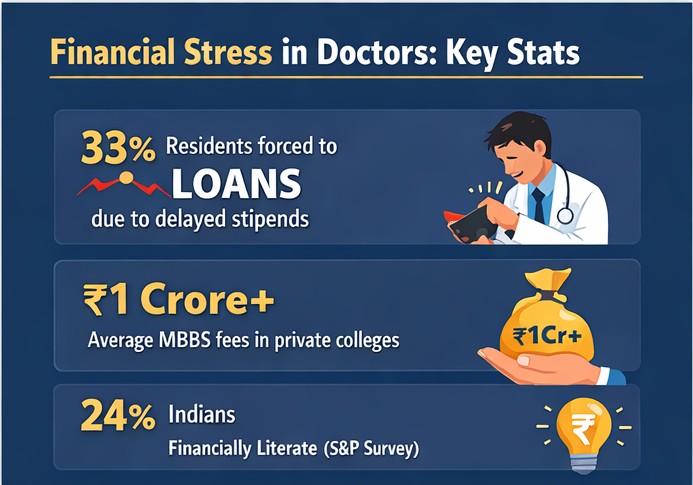

The National Centre for Financial Education (NCFE) reported that only 27% of Indian adults are financially literate (2019).²

The S&P Global Financial Literacy Survey showed India’s financial literacy at 24%, significantly below countries like the UK (66%), Australia (67%), and the US (57%).³

This global survey found that risk diversification, essential for investment planning, was among the lowest scoring areas in India.⁴

If most adults struggle with basic finance concepts, expecting overworked medical professionals to tackle taxes, retirement planning, or investment strategies on their own sets them up for failure.

2. Unique Financial Realities for Indian Doctors

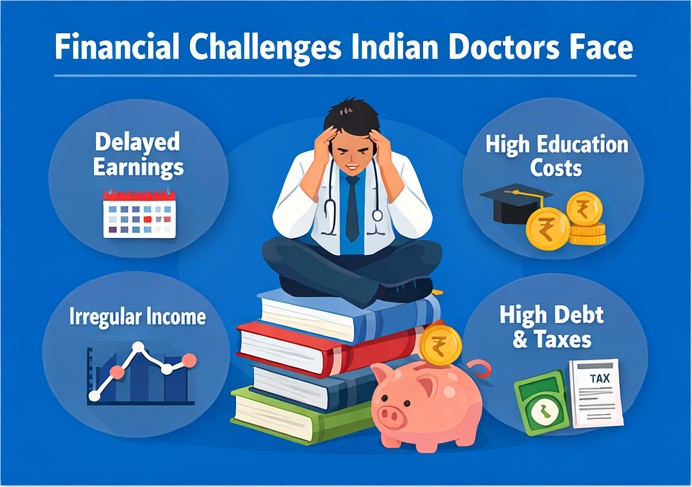

a. Delayed Earning Years

Becoming a doctor in India typically involves:

- 5½ years of MBBS/BHMS/BAMS/BUMS plus internship

- Competitive PG entrance preparation (often 1–2 years)

- Residency or senior residency (2–3 years)

Many medical graduates begin earning years later than peers in engineering or business fields. This delay affects their savings and investment potential, leading to long-term costs.⁵

b. High Education Costs

Medical education in India has grown increasingly expensive, especially in private and deemed universities, where MBBS fees can exceed ₹1 crore per seat at some institutions.⁶ High upfront costs create pressure to recover these expenses quickly, pushing some doctors into risky financial decisions.

c. Irregular Income for Private Practitioners

Unlike salaried jobs, clinic revenues can vary widely due to:

- Weekly and monthly fluctuations

- Dependence on referrals, competition, and patient volumes

- Insurance reimbursements or delayed payments

This variability raises stress levels and complicates budgeting without basic financial planning tools.

3. Financial Stress Is Already Affecting Medical Trainees

Medical training in government hospitals or colleges isn’t always financially stable:

A survey of resident doctors in Maharashtra found that about one-third were forced to take loans due to delayed stipends. This situation could have been eased with basic financial planning and emergency funds.⁷

Financial strain early in a medical career links to higher burnout rates, worse mental health outcomes, and lower long-term job satisfaction.

4. Money Matters for Physician Well-Being and Patient Care

Burnout among doctors is a complex issue. Research in 2025 identified significant burnout and psychological distress among health professionals, with financial insecurity as one contributing factor alongside heavy workloads and emotional fatigue.⁸

Ongoing financial stress heightens the risk of:

- Depression and anxiety

- Reduced quality of patient care

- Career dissatisfaction and turnover

Helping doctors manage their finances better is not just a professional issue—it affects clinical quality and the sustainability of the healthcare system.

5. The Cost of “No Financial Curriculum”

Here’s what happens when physicians lack financial literacy:

Bad Debt Decisions

High-interest borrowing, decisions to expand clinics without returning on investment analysis, and a lack of emergency funds can trap professionals in cycles of debt.

Under-Insurance and Catastrophic Risk

Many doctors go underinsured or choose inappropriate products, increasing their vulnerability during health emergencies.

No Retirement Planning

Doctors often begin investing later than other professionals, relying on family assets or haphazard investments instead of solid retirement planning.

Poor Investment Choices

A lack of understanding about diversification, compounding, and risk allocation leads to reactive investments based on trends, tips, or unregulated products.

6. What Should Financial Education for Doctors Include?

A basic financial curriculum for doctors should cover practical, career-focused topics:

a. Budgeting & Cashflow Management

- Creating basic monthly budgets

- Planning for irregular income

- Establishing emergency funds (covering six months of clinic and personal expenses)

b. Tax & Compliance

- Income classification

- Year-round tax planning

- Good documentation and record-keeping habits

c. Debt Strategy

- Differentiating between productive and unproductive debt

- Strategies for prioritizing and paying off loans

d. Insurance Basics

- Term life, health, and disability insurance

- Professional indemnity insurance

e. Investment Fundamentals

- Asset allocation

- Index funds versus active funds

- Risk tolerance and long-term compounding

f. Business Finance for Clinics

- Separating personal and clinic finances

- Understanding profit and loss statements and basic KPIs

- Managing pricing, hiring, and costs

7. Practical Roadmap for India

For Medical Colleges

- Mandatory financial literacy programs

- Tools and templates for budgeting and tax management

- Case studies relevant to physician income situations

For Professional Bodies and CMEs

- Regular webinars and workshops

- CME credits for attending financial courses

For Senior Doctors

- Mentoring and fostering open conversations about money

- Encouraging early planning for finances among mentees

Conclusion

Financial literacy isn’t just an added benefit for doctors—it’s a stabilizing factor for careers, a way to improve mental well-being, and a builder of professional resilience.

By recognizing the unique financial pressures physicians face in India and actively providing them with practical money management skills, we enhance their futures and improve the quality and sustainability of the medical field.

If you would like to improve your financial literacy and learn how to invest judiciously and grow rich, you can join our upcoming course Personal Finance for Doctors.

References

1. National Centre for Financial Education, Financial Literacy & Inclusion in India – 2019 Report (NCFE, 2019), [https://ncfe.org.in/wp-content/uploads/2023/12/NCFE-2019_Final_Report.pdf](https://ncfe.org.in/wp-content/uploads/2023/12/NCFE-2019_Final_Report.pdf).

2. Ibid.

3. S&P Global, “Two-Thirds of Adults Worldwide Are Not Financially Literate,” press release, November 18, 2015, [https://press.spglobal.com/2015-11-18-Two-Thirds-of-Adults-Worldwide-Are-Not-Financially-Literate-and-Significant-Gender-Gap-Exists-Finds-Global-Study](https://press.spglobal.com/2015-11-18-Two-Thirds-of-Adults-Worldwide-Are-Not-Financially-Literate-and-Significant-Gender-Gap-Exists-Finds-Global-Study).

4. Ibid.

5. Times of India, “Stipends Late, 1/3rd Resident Docs Forced to Take Loans – Survey,” Times of India, January 18, 2026, [https://timesofindia.indiatimes.com/city/mumbai/stipends-late-1-3rd-resident-docs-forced-to-take-loans-survey/articleshow/125938627.cms](https://timesofindia.indiatimes.com/city/mumbai/stipends-late-1-3rd-resident-docs-forced-to-take-loans-survey/articleshow/125938627.cms).

6. Medical Dialogues, “NEET 2025: 36 Deemed Universities Hike Fees; MBBS Now Costs Over Rs. 1 Crore at 32 Institutes,” March 2025, [https://medicaldialogues.in/news/education/medical-admissions/neet-2025-36-deemed-universities-hike-fees-mbbs-now-costs-over-rs-1-crore-at-32-institutes-152079](https://medicaldialogues.in/news/education/medical-admissions/neet-2025-36-deemed-universities-hike-fees-mbbs-now-costs-over-rs-1-crore-at-32-institutes-152079).

7. Times of India, “Stipends Late …”

8. Journal of the Association of Physicians of India (JAPI), “Burnout Levels and Predictors Among Healthcare Professionals,” JAPI 73, no. 7 (2025), [https://www.japi.org/article/japi-73-7-29](https://www.japi.org/article/japi-73-7-29).